New Ctc Increase April 2024 Update

New Ctc Increase April 2024 Update. Jason smith (r., mo.) said the plan includes a phased increase to the refundable portion of the child tax credit. Increase the amount of the credit that can be provided on a refundable basis from $1,600 to $1,800 in 2023, $1,900 in 2024, and $2,000 in.

With the introduction of the income tax rule changes from april 1, 2024, the basic exemption limit has been elevated from rs.2.5 lakhs to rs.3 lakhs. Federal lawmakers have proposed a $78 billion bipartisan bill that enhances the child tax credit by.

On January 19, 2024, The House Ways And Means Committee Approved The Tax Relief For American.

The tax relief for american families and workers act of 2024 is currently making its way to the senate would raise the refundable portion cap of.

Ron Wyden (D., Ore.) And Rep.

January 16, 2024 / 6:59 pm est / cbs news.

A Bipartisan Group Of House And Senate Lawmakers Agreed On Jan.

Images References :

Source: www.zrivo.com

Source: www.zrivo.com

Child Tax Credit CTC Update 2024, Ron wyden (d., ore.) and rep. The tax relief for american families and workers act of 2024 is currently making its way to the senate would raise the refundable portion cap of.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T210024 Increase Child Tax Credit (CTC) Amount to 3,000 (3,600 for, Centrist democrats demand cutting down child tax credit. January 31, 2024 at 8:39 p.m.

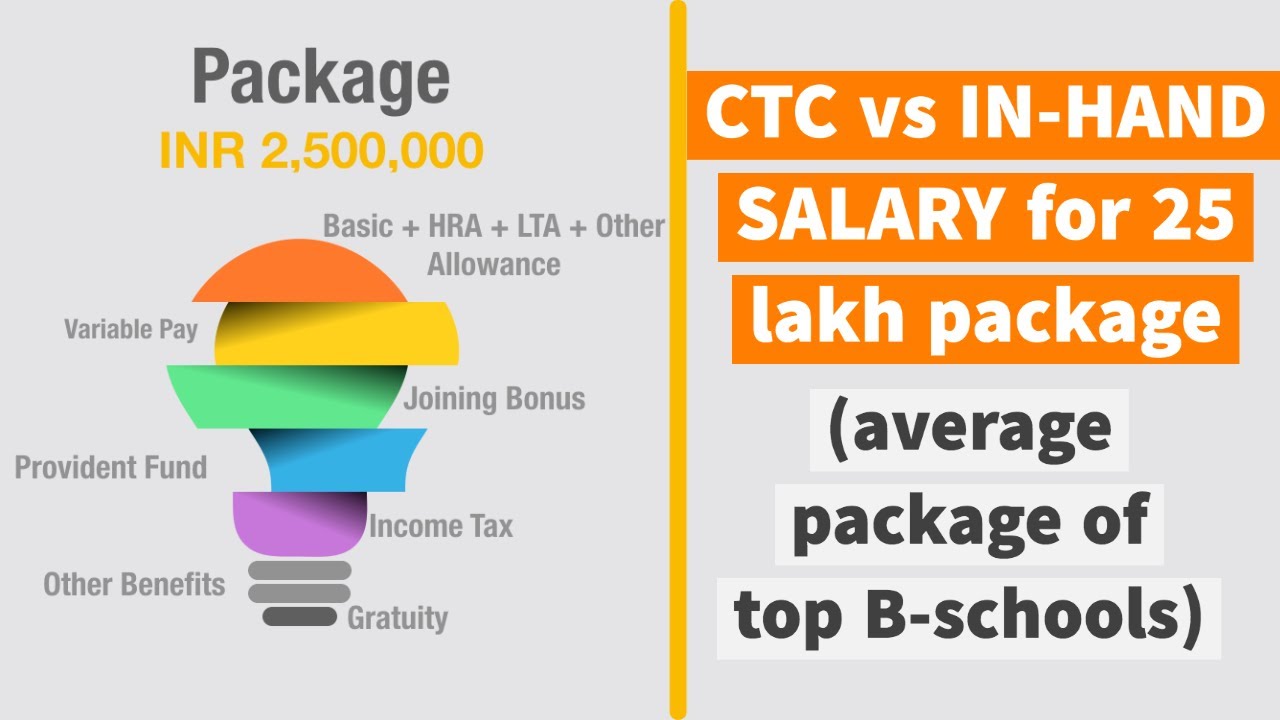

Source: www.youtube.com

Source: www.youtube.com

CTC Vs Actual Takehome salary I Reality of 25 Lakh Package in India, January 16, 2024 1:57 pm est. With the introduction of the income tax rule changes from april 1, 2024, the basic exemption limit has been elevated from rs.2.5 lakhs to rs.3 lakhs.

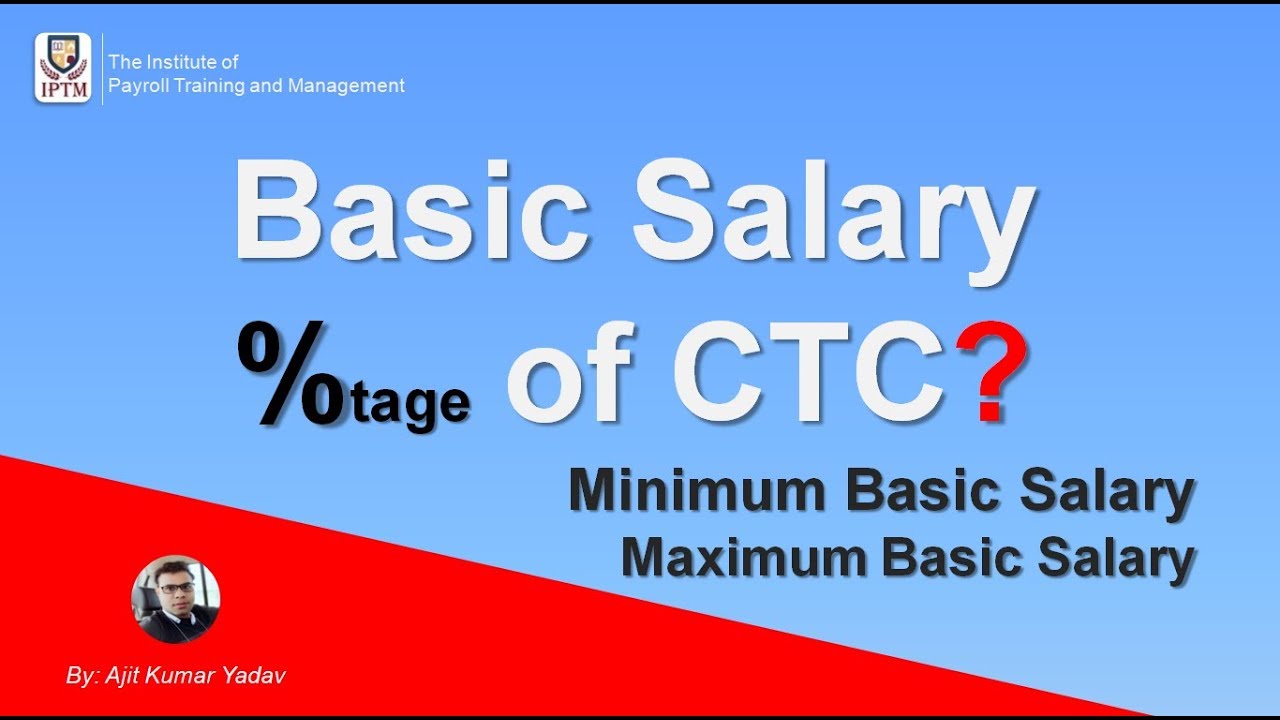

Source: www.youtube.com

Source: www.youtube.com

NEW 2023 SNAP UPDATE (OCTOBER) NEW 10 SNAP INCREASE APPROVED!!! 250, 7024, the “tax relief for american families and workers act of 2024,” as ordered reported by the committee on ways and means, on january 19, 2024. If passed, the bill would incrementally raise the amount of the credit.

Source: www.agastiyabiotech.com

Source: www.agastiyabiotech.com

mCRPC Agastiya Biotech, The child tax credit (ctc) can help families with the costs of raising children. If passed, the bill would incrementally raise the amount of the credit.

Source: www.youtube.com

Source: www.youtube.com

Basic Salary Percentage of CTC Calculation Simply Explained by, Here’s what it means for you. If passed, the bill would incrementally raise the amount of the credit.

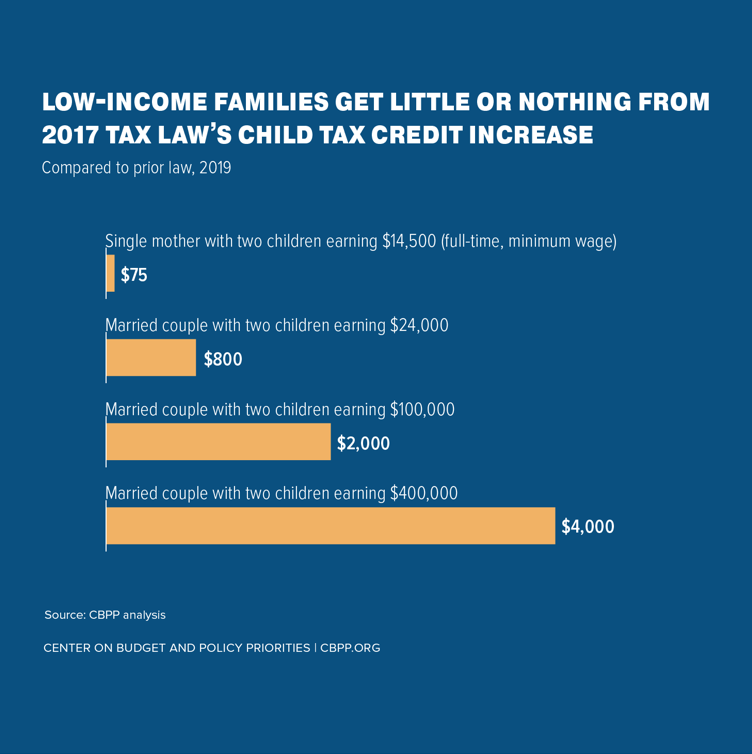

Source: www.cbpp.org

Source: www.cbpp.org

Tax Day 2019 Charts Working Families Should Be Priority of, How will the child tax credit change in 2024. Ron wyden (d., ore.) and rep.

Source: oyehero.com

Source: oyehero.com

CTC and Gross Salary Difference in Hindi CTC और सकल वेतन में अंतर, How will the child tax credit change in 2024. The house voted wednesday to expand the child tax.

Source: www.epi.org

Source: www.epi.org

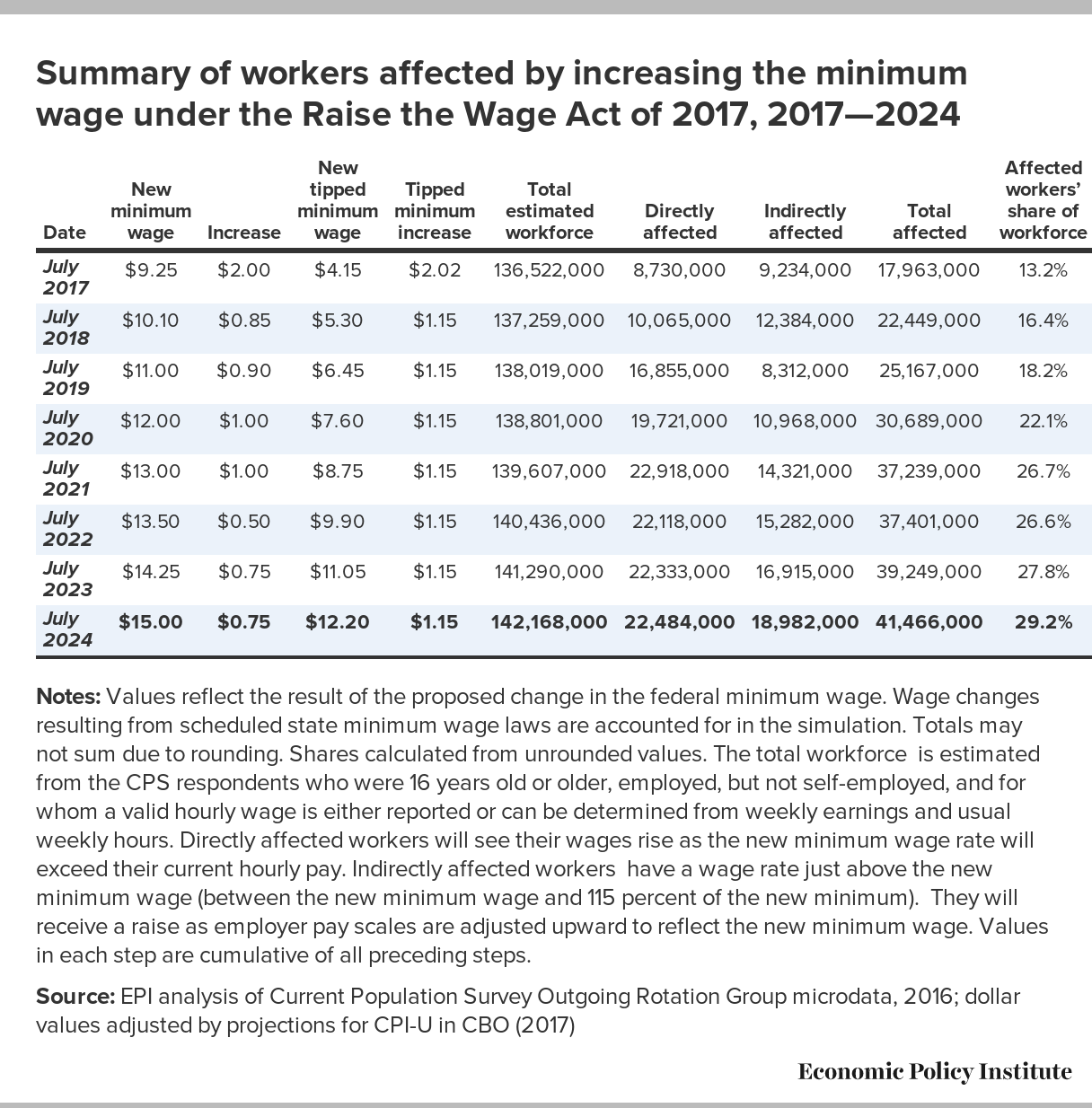

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, The framework suggests increasing the maximum refundable portion of the ctc from the current $1,600 per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025. Federal lawmakers have proposed a $78 billion bipartisan bill that enhances the child tax credit by.

Source: www.herzindagi.com

Source: www.herzindagi.com

What Is CTC, How To Answer Questions Related To It In An Interview, If passed, the bill would incrementally raise the amount of the credit. Jason smith (r., mo.) said the plan includes a phased increase to the refundable portion of the child tax credit.

Increase The Amount Of The Credit That Can Be Provided On A Refundable Basis From $1,600 To $1,800 In 2023, $1,900 In 2024, And $2,000 In.

Child tax credit eligibility 2024.

Federal Lawmakers Have Proposed A $78 Billion Bipartisan Bill That Enhances The Child Tax Credit By.

Here’s what it means for you.